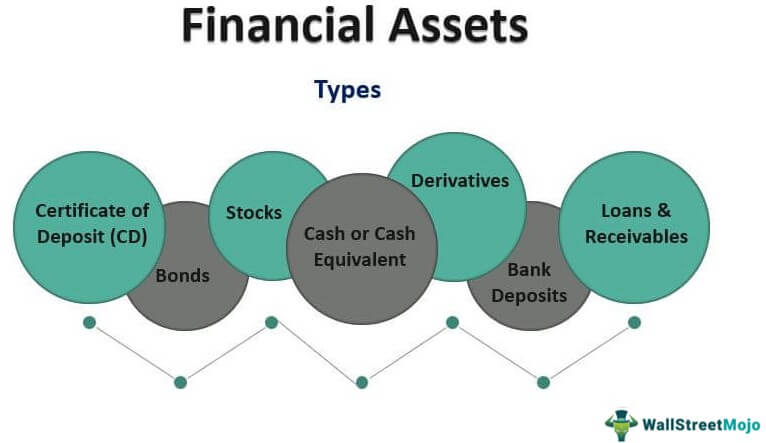

Individuals usually think of assets as items of value that they could convert into cash at some future point and that might also be producing income or appreciating in value in the meantime. Those can be financial assets like stocks, bonds, and mutual funds, or physical assets like a home or an art collection. Cash and cash equivalents include liquid assets like bank deposits, money market funds, and short-term government securities.

By business type

Then, research and select stocks or other investments that fit within those parameters. Regular monitoring and updating are often required, along with entry and exit points for each position. Rebalancing requires selling some holdings and buying more of others so that most of the time, your portfolio’s asset allocation matches your strategy, risk tolerance, and desired level of returns. People generally believe that stocks, bonds, and cash comprise the core of a portfolio.

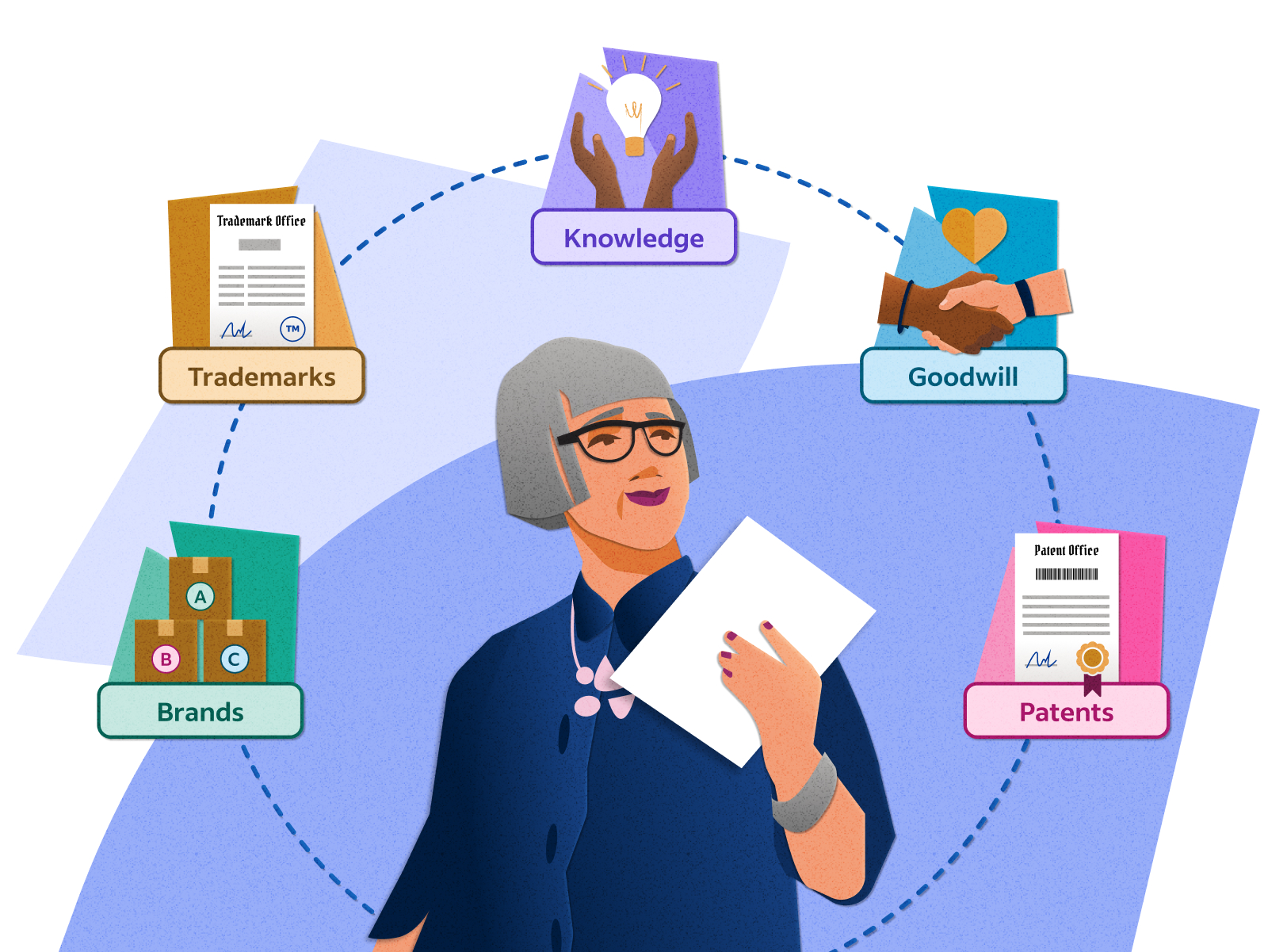

Foreign Exchange Instruments

They do not necessarily have inherent physical worth like land, property, commodities, etc. These are legal claims, and these legal contracts are subject to future cash at a predefined maturity value and predetermined time frame. It always needs to have a good record of its financial assets list to be put to use whenever needed, like in financial emergencies. When it comes to tax season, the IRS requires real and financial assets to be reported together as tangible assets. Real assets are physical assets that draw their value from substances or properties, such as precious metals, land, real estate, and commodities like soybeans, wheat, oil, and iron. This type of portfolio makes money from dividend-paying stocks or other types of distributions to stakeholders.

- Some calculators may use different methods to compute the interest rate per period, leading to varying results.

- They include futures, forwards, and options contracts that use a commodity as the underlying asset.

- Fixed-income securities, such as bonds, represent loans made by investors to corporations or governments.

- Some examples of financial instruments include stock shares, exchange-traded funds (ETFs), bonds, certificates of deposit (CDs), mutual funds, loans, and derivatives contracts.

- The increase in corporate costs primarily reflects certain one-time expenditures related to strategic corporate initiatives.

- Generally speaking, assets are a good thing to have, and liabilities less so.

Time Horizon and Portfolio Allocation

Your goals for the future, your appetite for risk, and your personality are all factors in deciding how to build your portfolio. In May 2017 when IFRS 17 Insurance Contracts was issued, it amended the derecognition requirements in IFRS 9 by permitting an exemption for when an entity repurchases its financial liability in specific circumstances. IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies. The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards. Exchange-traded derivatives in this category include stock options and equity futures.

To get a better understanding of what is classified as a financial asset, let’s take a look at Home Depot’s balance sheet as of May 2, 2021, per the U.S. In the case of banks, financial assets include the worth of the outstanding loans it has made to customers. Capital One, the 9th largest bank in the U.S., reported $481,720 million in total assets on its first-quarter 2024 financial statement; of that, $315,154 million were from real estate-secured, commercial, and industrial loans. Liquidity is the ability to change a financial asset into cash quickly.

Simply put, an asset is something of value that you own or that is owed to you. If you lend money to someone, that loan is also an asset because you are due that amount. An asset is a resource with economic value that an individual, a company, or a country owns or controls with the expectation that it will provide a future benefit. They are debt securities in which the company or government promises to repay the principal along with interest at a specified maturity date. Grant Gullekson is a CPA with over a decade of experience working with small owner/operated corporations, entrepreneurs, and tradespeople. He specializes in transitioning traditional bookkeeping into an efficient online platform that makes preparing financial statements and filing tax returns a breeze.

In the case of equities like stocks and bonds, an investor has to sell and wait for the settlement date to receive their money—usually one business day. Altus Group’s Dividend Reinvestment Plan (“DRIP”) permits eligible shareholders to direct their cash dividends to be reinvested in additional common shares of the Company. Full details of the DRIP program are available on the Company website. Portfolios can be constructed to achieve various strategies, from index replication to income generation to capital preservation.

The straight-line method assumes that a fixed asset loses its value in proportion to its useful life, while the accelerated method assumes that the asset loses its value faster in its first years of use. Financial assets are more liquid than tangible assets, i.e. they can be turned into cash more rapidly. Cash is considered to be the safest financial asset for the average investor.

The effective annual rate (EAR) includes the effects of intra-year compounding, providing a more accurate representation of the actual interest accrued. Some calculators may use different methods to compute the interest rate per period, leading to varying results. Our method aligns with standard financial practices to provide accurate calculations. It was found that out of 1000 households, at least two would invest in risk assets if there was a bank branch present within a 5 Km radius of their home. This study not only examines the availability of a bank but also the availability of information and support.

They function similarly to loans in that the borrowing organization promises to pay the bond back at an agreed-upon date. They enable companies to finance short-term projects and tend to offer modest returns. To fully understand how financial assets work, it’s best to explain the types of financial assets in detail, as each one functions differently. happy 4th of Financial assets are considered liquid because they generally can be sold easily but can also lose value over time. If a company or individual has high liquidity, that means they have enough assets to meet financial obligations. Similar to risk tolerance, investors should consider how long they have to invest when building a portfolio.

This type of asset is used in the balance sheets of many businesses as well as universities, including Cornell University. The most common type of personal financial assets are bank deposits and investment portfolios. In the U.S., according to recent data, the majority of personal financial assets are held specifically in checking accounts, with the second most-used financial asset being retirement accounts. For financial assets to be measured at fair value through profit or loss by designation, designation is only possible at the amount the asset was initially recognized at. Moreover, designation is not possible for equity instruments which are not traded in an active market and the fair value of which cannot be reliably determined.