Each transaction bookkeeping is entered as both a debit and a credit in corresponding accounts to keep the accounting equation balanced. These entries are first documented in a journal and then posted to the general ledger. The final step involved in transaction analysis is to apply the rules of debit and credit on accounts. Under the double-entry system of accounting, a transaction essentially involves at least two accounts.

Step 7: Verify accuracy

- The final step involved in transaction analysis is to apply the rules of debit and credit on accounts.

- Every economic transaction your business makes must be classified into its proper categories, which include assets, liabilities and net worth.

- For example, when a company purchases inventory, sells products, pays employees, or receives payment from customers, these are all transactions.

- Now that you’ve gained a basic understanding of both the basic and expanded accounting equations, let’s consider some of the transactions a business may encounter.

- This can lead to incorrect log entries and mistakes in the accounting records.

- The process of analyzing a business transaction starts with identifying these accounts.

Items on the left hand side of the equation are increased by a debit and decreased by a credit, items on the right of the equation are increased by a credit and decreased by a debit. It is not taken from previous examples but is intended to stand alone. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

Reliable Outsourced Bookkeeping Solutions

The liability of $4,000 worth of services increases because the company has more unearned revenue than previously. In a T-account, a credit is a right-side entry that lowers the asset account and raises the liabilities or owner’s equity account. In accounting, transactions are classified as cash, credit, internal, external, and non-cash. This could be a sale, purchase, payment, receipt, or any other business activity that impacts financial records. The cash balance declined here because salary was paid to an employee. Recognizing an expense is appropriate rather than an asset because the employee’s work reflects a past benefit.

- Once the original source has been identified, the company will analyze the information to see how it influences financial records.

- In the above example, the two accounts involved are the cash account and capital account, both of which are increasing.

- In simple words, we can say that the cash account is classified as an asset account and Robert’s capital account is classified as an equity account.

- The change to liabilities will increase liabilities on the balance sheet.

What Is Accounting Transaction Analysis?

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Identify from the source documents the monetary amount to be entered for each account.

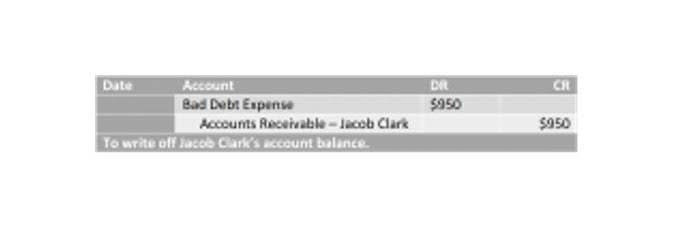

The entire cycle is meant to keep financial data organized and easily accessible to both internal and external users of information. Transfer the journal entries to the general ledger, which consolidates all accounts and provides a detailed record of each account’s activity. Let us understand with an example how transactions are recorded using the double-entry bookkeeping method.

Sequentially, it is a part of the overall journalizing process, which is the next step of the accounting cycle. Each business transaction must be properly analyzed so that it can be correctly journalized and made part of the entity’s accounting record. As a result, the revenue recognition principle requires recognition as revenue, which increases equity for $5,500.

- A company can recognize an accrued expense (such as a salary) as incurred or wait until payment.

- The income statement would see an increase to revenues, changing net income (loss).

- Net income (loss) is computed into retained earnings on the statement of retained earnings.

- Cash transactions provide immediate liquidity, making them easy to track and manage.

- Every time money moves in or out of the business, it’s recorded as a transaction.

- Look at the summary of their transaction analysis during a particular time frame.

- The liability of $4,000 worth of services increases because the company has more unearned revenue than previously.

Decide whether each account affected is an asset, liability, equity, revenue, or expense. This classification helps in understanding how the transaction impacts the accounting equation. The proper analysis of business transactions is important because it ensures that entries in the journal are correct. In the second step, classify the nature of the accounts identified in the first step. In the JoTech Ventures transaction, the Cash Account is an asset account, while John’s Capital Account is an equity account.

How do we determine the effects in terms of increase and decrease?

Internal transactions are financial activities that happen within a company without involving any external party. Examples include recording depreciation, inventory adjustments, or transferring assets between departments. These transactions don’t result in an exchange of cash but affect the company’s internal financial records. They help in accurately reflecting the business’s asset value, expenses, or other financial changes within the organization. A company can recognize an accrued expense (such as a salary) as incurred or wait until payment. The end result (an https://www.facebook.com/BooksTimeInc expense is reported and cash decreased) is the same, but the recording procedures differ.

How many accounts need to be involved in every business transaction?

T-accounts use debits, which increase the balance of asset accounts and lower the amount of debt or owner’s equity accounts, respectively. As stated earlier, every valid business transaction has a financial impact on the entity’s business. This simply refers to increase(s) or decrease(s) in accounts identified in the first step. The cash comes into the business, and at the same time, the owner’s capital or equity comes into existence. Therefore, when you use the double-entry method, for every debit you have, there will be a corresponding credit equal to the same amount, and vice versa. transaction analysis accounting This keeps your accounting equation in balance, so you know that if it’s not balanced, then you’ve made a mistake in your bookkeeping.